Labor Report

I.- New release for the settlement of Social Security obligations. Version 42 Release 7 SICOSS. Online declaration. General Resolution (AFIP) No. 4849/2020

To date, November 4, 2020, the reference standard has been published in the Official Gazette, which establishes the obligation to prepare and present the Affidavits of Social Burdens (F. 931). in accordance with release 7 of version 42 of the Social Security Obligations Calculation System (SICOSS), and Online Declaration, as of October 2020 and following.

In particular, a new status code is incorporated to declare the workers included in article 24 of Decree 792/2020 (Code 50 - Table T03” of Annex IV of General Resolution No. 3834 AFIP).

For workers declared with the magazine status code cited, the personal contributions and employer contributions corresponding to the Social Work and the National Institute of Social Services for Retirees and Pensioners -INSSJP- Laws Nos. will be calculated on the taxable remuneration. . 23,660, 23,661 and 19,032.

II.- Resolution No. 4/2020 of the Ministry of Labor, Employment and Social Security – National Council of Employment, Productivity and the Minimum, Vital and Mobile Wage”

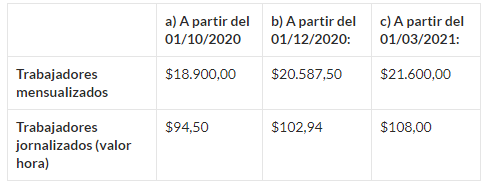

We remember that on October 20, 2020, the reference standard was published in the Official Gazette, which establishes the increases in the minimum, vital and mobile salary, in three stages, namely:

The values of the minimum vital and mobile wage are useful data and a mandatory reference parameter for the purposes of determining the amounts of remuneration that will be subject to seizure, in all those cases in which companies must complete judicial seizure orders. regarding some of its workers in accordance with the percentages and limits of the law.

For these purposes, the provisions of Decree 484/87 (regulatory of articles 120, 147 and 149 of the Employment Contract Law No. 20,744) become relevant, which establishes that the remuneration accrued by workers in each period monthly, as well as each SAC fee cannot be seized up to a sum equivalent to the SMVyM.

The seizure limits established in the Decree are: 10% of what exceeds the SMVyM when the remuneration (gross) of the worker does not exceed twice the SMVyM; and 20% of what exceeds the SMVyM when the worker's (gross) remuneration exceeds double the SMVyM.

Compensation due to the worker or his successors due to the employment contract or its termination are also seizable in the aforementioned proportions.

It should be clarified that the seizure limits established in the aforementioned Decree are not applicable to cases of maintenance or expense litigation, in which cases it will be necessary to adhere to the percentages indicated in the corresponding judicial seizure order.-

Related to the topic, we finally remember that, in accordance with the modification introduced by Law 27,320 (BO 16/12/16) to Art. 147 of the Employment Contract Law No. 20,744, the non-seizability of the accounts was established. salary, further providing that tAny embargo that affects the salary of workers must be implemented before the employer so that he can make the corresponding withholdings. Likewise, the employer's obligation is introduced to inform the worker of wage seizures within 48 hours, and the employer must provide a copy of the judicial resolution documenting the ordered measure.-

III.- ATP PROGRAM: DNU N° 823/2020- DEC. ADVA. 1954/20 - RES. AFIP 4844/20

We remember that on October 27, 2020, the reference standard was published in the Official Gazette, the reference standard through which the established “Emergency Assistance Program for Work and Production – ATP” is extended in Decree No. 332/2020, until December 31, 2020.

Also on 10/29/20 through Administrative Decision 1954/20, the Head of the Cabinet of Ministers adopts a series of recommendations from the Program Evaluation and Monitoring Committee, related to the extension of the complementary salary for critically affected activities, required nominal billing variation, reduction benefit 95% of employer contributions destined for the SIPA Employer contributions destined for the SIPA for companies that carry out activities classified as “critical” according to the current list, as long as they meet the conditions to be beneficiaries of the Complementary Salary, benefit of the postponement of payment of the employer contributions to the SIPA, for companies that carry out activities classified as “non-critical” and credits at a subsidized rate.

We also remember that the AFIP through general resolution (AFIP) 4844 of 10/30/20 officialized the activation of the web service “Emergency Assistance Program for Work and Production – ATP”, from October 29 to November 4, both dates inclusive so that employers can register and request the benefits of the ATP Program in accordance with the provisions of the administrative decision of the Chief of the Cabinet of Ministers 1954 of October 28, 2020.

IV.- HOLIDAY REMINDER MONTH NOVEMBER 2020

We remind associated companies that in accordance with current legislation on the matter, next Monday, November 23 marks the national holiday corresponding to National Sovereignty Day (November 20). -

IV.- REMINDER: GRANTING VACATIONS TO STAFF

The Legal-Labor Department of AIM Rosario reminds associated companies of the main legal regulations applicable to the subject of reference, provided by the Labor Contract Law No. 20,744 (Arts. 150 to 157, following and concordant), which They are applicable to metal workers.

1.- Communication and granting time: communication to the worker of his ordinary leave (minimum and continuous period of annual rest commonly known as “Vacation”) must be made in writing and 45 days in advance, and the employer must grant the enjoyment of the same in the period from October 1 to April 30 of the following year.

The application authority, by means of a reasoned resolution, may authorize the granting of vacations in periods other than those established when so lor requires the special characteristic of the activity in question.

When vacations are not granted simultaneously to all workers employed by the employer in the establishment, workplace, section or sector or where they work, and they are agreed upon individually or by group, the employer must proceed in such a way that each worker is entitled to enjoy them for at least one summer season every three periods.

In the event that a couple works under the orders of the same employer, vacations must be granted jointly and simultaneously, as long as it does not significantly affect the normal development of the company.

2.- Beginning of vacation: They must always begin on MONDAY, unless this is a holiday or optional non-working day and the company has decided not to work, in which case the leave must be valid.start the next business day.

3.- Requirement for full enjoyment: The essential conditions for the granting and full enjoyment of the vacation period consist of the worker having provided services for at least half of the business days included in the year; Otherwise, they will enjoy one day of vacation for every twenty days actually worked, counting for such purposes the days in which the worker has not provided services due to enjoying a legal or conventional license (vacations, deaths, exams, etc.), or because they are sick or injured or for other reasons not attributable to him.

4.- Calculation of seniority: It is necessary to take into account that to determine the number of days that correspond to vacation (14, 21, 28 or 35 consecutive days depending on whether the seniority does not exceed 5, 10, 20 toyears or exceeds 20 years, respectively), the seniority of the worker as of December 31 of the year to which the vacations correspond is computed. In addition, it must be kept in mind that the length of previous effective service that the worker could have in the same company is counted as seniority.

5.- Vacation payment: In accordance with the provisions of the L.C.T., the remuneration corresponding to the entire vacation period must be paid in full at the beginning of the vacation.

In order to determine the value of each vacation day and then multiply it by the number of days that corresponds in each case, the law distinguishes:

a) monthly workers: the amount of the salary received at the time of granting vacation must be divided by 25. b) workers paid per day or hour: paid for each dayThe vacation amount is the amount that the worker would have been entitled to receive on the day prior to the date on which the enjoyment of the vacation begins. If the usual working day is longer than 8 hours, the actual working day will be taken as the working day, as long as it does not exceed 9 hours. When the working day taken into consideration is, for circumstantial reasons, less than usual, the remuneration will be calculated as if it coincided with the legal one.

6.- Case of variable remuneration: (overtime, awards, piecework, commissions, etc.): The salaries earned must be averaged during the year that corresponds to the granting of vacations, or at the option of the worker during the last six months of service provision.

7.- Closure of the establishment: In the event that the employer orders the closure of the establishment and there are workers whose vacation period is less than the periodof closure, or do not have the right to vacation due to their recent entry, so that the employer can legally suspend them without paying salaries, they must have prior authorization from the application authority, who may not accept as fair the cause for suspension that is invoke.

8.- Compensation for vacations not taken: When the termination of the employment relationship occurs for any reason, the worker (or his successors in the case of his death) will have the right to receive compensation equivalent to the salary corresponding to the period. of rest proportional to the fraction of the year worked. This case should not be confused with the one contemplated in point 3) of the present, since for the settlement of the vacation period it will be proportional when the breaking of the employment relationship occurs, it is not required that the workeror has completed at least half of the business days included in the year. That is why in this case, 1 day every 20 days should not be settled, but the compensation for untaken vacations should be calculated (which, due to its nature, does not include contributions) applying the rule of proportionality.

9.- Prohibition of monetary compensation: Vacations are not compensable in money, except in the case to which we have referred when discussing point 8 (liquidation due to termination of the employment relationship)

10.- Failure to grant: If the deadline for notifying the worker of the start date of his vacation has expired, the employer has not done so, he will make use of that right after reliable notification thereof, so that those conclude before May 31.

11.- Accumulateation: The law admits two possibilities, namely:

a) Accumulation of vacation plus vacation: Only the possibility of accumulating to ordinary vacations a third of the previous ones not enjoyed "in the extension established by this law" is admitted. That is, only the accumulation of a complete period with a third of another is allowed, but this is also subject to the following conditions: 1) the accumulation allowed is only of the current period with part of the immediately preceding period. Accumulation with subsequent vacations is not possible; 2) the allowed accumulation can be less than one third but never more; c) accumulation only proceeds in the case of agreement between the parties, which must be specified at the moment in which part of the vacation is transferred to integrate it with the following period./p>

b) Accumulation of vacation with the marriage license: This is another exception to the general principle regarding the moment of granting the vacation, since these can be accumulated with the special marriage license (which according to art. 158 inc. b and CCT 260/75 consists of 10 calendar days. Related to the topic, we remember that the LCT establishes in the case of a marriage under the orders of the same employer, the right to joint and simultaneous enjoyment for both spouses “as long as it does not noticeably affect the normal development of the establishment.”

· OTHER CASES NOT CONTEMPLATED IN THE EMPLOYMENT CONTRACT LAW:

Interruption of vacation due to accident or illness: Although the L.C.T. does not regulate on the subject, uncontroversial jurisprudence comes historicallycute;richly maintaining that the worker who is injured or sick during vacation has the right to complete, once discharged, the rest period that he was deprived of enjoying for said reason. For this interruption to operate, the worker must give notice to the employer denouncing his current residence address, so that if the employer wants to verify the illness or accident through the medical service, he can exercise said power. Outside of the explicit assumption, no antecedents of other causes have been specifically detected that could lead to the conclusion that the interruption of vacation enjoyment is appropriate.

Holidays coinciding with vacations: It is another legal loophole in the L.C.T. , and as such could give rise to different interpretations. Now, assuming that holiday pay obeys the principle of not reducing remunerationof the worker, the criterion that this Advisory has been maintaining is that national holidays coinciding with the vacation period of daily workers should NOT be settled separately added to the vacation pay, since the worker has already paid the salary for the latter concept and in that payment is the salary corresponding to the holiday, not giving rise to the extension of the vacation period.-

It should also be noted that despite the current extraordinary circumstances that we are going through as a result of the covid-19 pandemic, the provisions of the ASPO AND DISPO dictated by the national and provincial executive power, remain in force in the matter. and without legal modifications the cited norms of the Employment Contract Law, without specific norms being issued to date by the enforcement authority regardingprivate sector workers that regulate specific issues related to ordinary annual leave during the pandemic. Notwithstanding this, if doubts and/or queries related to the subject arise, this Labor Department is available to the associate to channel them.

V.- REMINDER: SITUATION OF WORKERS OVER 60 YEARS OF AGE AS A RISK GROUP AGAINST COVID-19

Res. 207 MTSS remains fully in force, exempting those over 60 years of age from attending tasks. The UOM/ADIMRA Agreement 223 bis of 04/28/20, recently extended, allows these workers (except pregnant women) to be incorporated into the non-remunerative benefit of 70% gross under the conditions stipulated in point 2.2. of such Agreement. As a GENERAL RULE applicable is that people over 60 years of age mustremain in isolation; b) The EXCEPTION to the rule is that it is exclusively about "essential personnel for the proper functioning of the establishment", a subjective circumstance that in principle would be determined by the employer in the exercise of management powers and organization (except in the health sector where all personnel are essential because this is what the standard determined).

Given the repeated queries from associates regarding the treatment of this age group of workers who are in isolation, we invite those companies that have questions related to the issue to contact the AIM Labor Department in order to provide them with the pertinent explanations. -